Grandstone Investment Sales is pleased to present East Gate Storage, a high performing vehicle, equipment, and specialty storage facility on an 11-acre site in Manhattan, Illinois, approximately 30 miles southwest of Chicago. Offered at a 7.75% going-in cap rate and a basis well below replacement cost, the property delivers immediate income and clear upside through operational improvements, with projected stabilization cap rates exceeding 10% by Year 1. The five large-format buildings support an estimated total capacity of 500 stored vehicles, recreational assets, and equipment, and feature a valet-style operating model that is difficult to replicate and not currently offered by competitors in the trade area. The property has benefited from targeted

capital improvements following a July 2024 storm event, including partial roof and

structural repairs on one building and selective electrical upgrades.

Located at 15325 West Baker Road, the facility benefits from regional access, including less than one mile to Route 52 (±9,150 VPD) and fronting Baker Road (±2,650 VPD). It serves areas such as Manhattan, New Lenox, Mokena, and greater Will County, anchored by major employers including Amazon, IKEA Distribution, and Silver Cross Hospital. Limited competitive supply for large-format indoor storage supports durable long-term demand.

East Gate Storage presents immediate operational upside. It is owner-operated with onsite management, including a full-time manager who oversees grounds and snow, and the facility is equipped with a multi-camera video surveillance system. Economic occupancy is below market due to a meaningful portion of customers on legacy annual leases, creating a clear mark-to-market opportunity for a new operator through revenue management and modern leasing practices. The property has demonstrated meaningful long-term revenue growth, reinforcing the strength and durability of demand for this specialized storage product. Additional upside includes a cell tower lease under negotiation and long-term optionality across the expansive 11-acre site. The on-site 4- bedroom farmhouse, occupied by the manager, features a fully renovated exterior and newer HVAC, supporting both operations and value.

INVESTMENT

HIGHLIGHTS

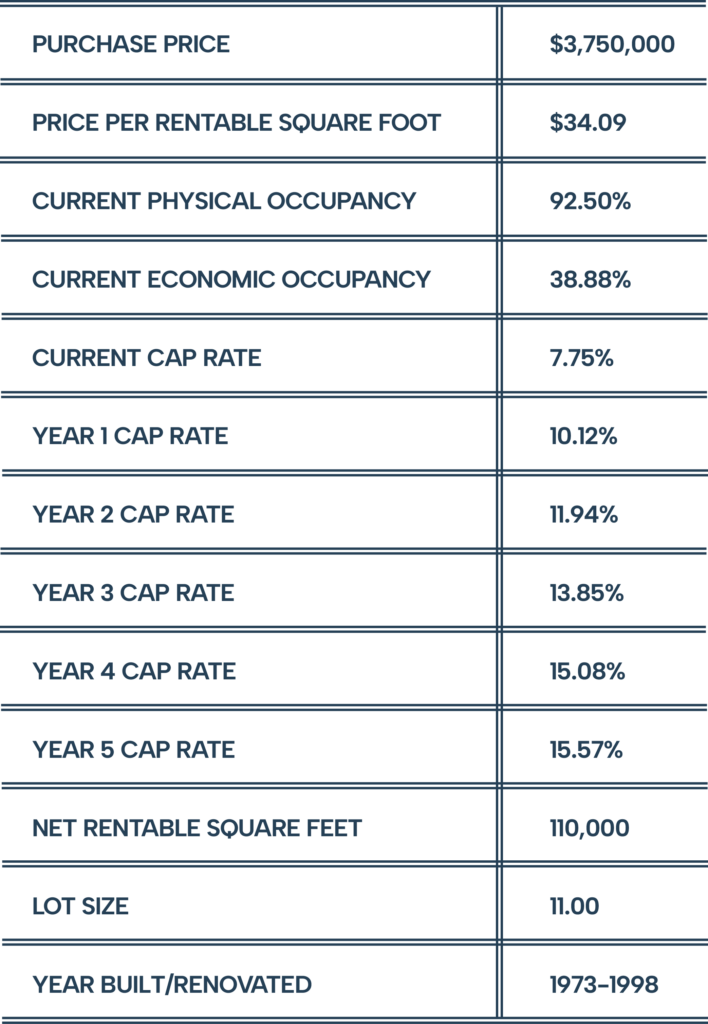

- PURCHASE PRICE: $3,750,000

- NET RENTABLE SQUARE FEET: 110,000 sf

- SITE SIZE: 11.0 acres

- ESTIMATED STORAGE CAPACITY: 500 vehicles, recreational assets, and equipment

- GOING-IN CAP RATE: 7.75% (projected >10% by year 1)

- OCCUPANCY: physical 92.5% / economic 38.9%

- BELOW-REPLACEMENT-COST BASIS: ~$34/sf, well below today’s development cost

- OPERATIONAL VALUE-ADD: meaningful portion of tenants on legacy leases, creating attractive mark-to-market opportunity

- DIFFERENTIATED VALET-STYLE STORAGE: large-format vehicle, RV, boat, and equipment storage with no other known valet-style operators in the trade area

- STRATEGIC ACCESS: <1 mile to Route 52 (±9,150 vpd) and fronting Baker Road (±2,650 vpd)

- ANCILLARY INCOME UPSIDE: cell tower lease in negotiation

- LONG-TERM LAND OPTIONALITY: 11-acre site provides future flexibility

- MARKET DEMAND: limited competition; strong employment base including Amazon, IKEA, Silver Cross Hospital

- EMBEDDED REVENUE GROWTH: demonstrated history of strong revenue growth

Brian Brockman | Bang Realty Inc | bor@bangrealty.com | License: 678573